Главная страница Случайная страница

Разделы сайта

АвтомобилиАстрономияБиологияГеографияДом и садДругие языкиДругоеИнформатикаИсторияКультураЛитератураЛогикаМатематикаМедицинаМеталлургияМеханикаОбразованиеОхрана трудаПедагогикаПолитикаПравоПсихологияРелигияРиторикаСоциологияСпортСтроительствоТехнологияТуризмФизикаФилософияФинансыХимияЧерчениеЭкологияЭкономикаЭлектроника

Method 3 General National Assessment

|

|

The objective: gauge a general measure of business risk or perhaps of broad

categories, such as financial risk, risk of violence, etc. at the national level.

- May be based on expert ratings or tracking of key variables (e.g. foreign currency

reserves, interest rates, etc. to gauge financial risk)

- This method is typically used to determine investment level in a country. Companies either stay out of risky countries or withdraw or limit investment in those.

50. What are the major trends in political risks analysis nowadays? Explain them. In your opinion, what is the difference between reactive and proactive approaches to international political risks management?

Trends: Analyses track changes that have led to loss in the past, either in the target country or others like it.

Example: A high level of unemployment creates problems,

but more issues arise as unemployment rises. Then, civil society tends to become disruptive. Analysts would track unemployment rates.

Proactive Motivations

• Profit advantage

• Unique products

• Technological advantage

• Exclusive information

• Managerial urge

• Tax benefit

• Economies of scale

• Minimization of competitive risk

• Attractive markets

Reactive Motivations

• Competitive pressures

• Overproduction

• Declining domestic sales

• Excess capacity

• Saturated domestic markets

• Proximity to customers and ports

• Clients go global

51. What are the factors and variables of political risks rating, modeling and forecasting suggested by the PRS Group and The Economist Intelligence Unit, and BERI?

PRS:

Each report provides the current level and likely time spans.

18-month (12 indicators): political turmoil; equity; restrictions; operations restrictions; taxation

discrimination; repatriation restrictions; exchange controls; tariff barriers; other import barriers;

payment delays; fiscal and monetary expansion; labor policies; foreign debt.

5-year (4 indicators): investment restrictions; trade restrictions; domestic economic problems;

international economic problems.

The Economist Intelligence Unit (EIU) Model:

-country risk model containing political, social, and economic/financial variables with a

total rating value of 100 points;

- variables represented “political risk” defined in terms of outcome losses covered by political risk insurance.

- score of zero meant no risk, the max score meant max (prohibitive) risk.

- Variables (weight): bad neighbors (3), authoritarianism(7), staleness (5), illegitimacy (9), generals in power (6), war/armed insurrection (20), urbanization pace (3), Islamic fundamentalism (4), corruption (6), ethnic tension (4).

Factors of the Composite EIU Risk Rating

- Political risk (22% of the composite)

a) Political stability (war, social unrest, orderly political transfer, politically motivated violence; and international disputes)

b) Political effectiveness (change in government orientation; institutional effectiveness; bureaucracy; transparency/fairness; corruption; and crime).

- Economic policy risk (28%)

Determined with 27 variables in five categories: monetary policy; fiscal policy; exchange rate policy; trade policy; and regulatory environment.

- Economic structure risk (27%)

Incorporates global environment, growth, current account, debt, and financial structure groupings with 28 variables.

- Liquidity risk (23%)

Covers 10 variables of currency conditions

The BERI Model:

-Business Environment Risk Intelligence (BERI) is a country risk model based on a

set of quantitative indices.

- Profit Opportunity Recommendation (POR) is a macro risk measure; an average of 3 ratings, each on a100-point scale. Represents all aspects of country risk:

-Political Risk Index (PRI) is composed of ratings on 10 political and social variables.

-Operations Risk Index (ORI) comprises 15 political, economic, financial, and structural variables.

-RFactor (Remittance and Repatriation), a weighted index covering the country’s legal framework, foreign exchange, hard currency reserves, and foreign debt.

- Risk is calculated for the present, as well as one-year and five-year frames

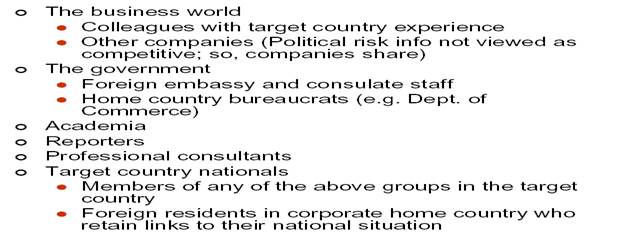

52. What are the best information sources for the political risks analysis?

The best are:

- Gvt specialists (15%): Recently retired from government service or are currently in service;

Positions in foreign policy, economic, defense, and intelligence agencies; Field experiences in the relevant country and have extensive governmental and nongovernmental

contacts.

Business specialists (5%): Work for MNCs, banks or associations that serve international business; Have had professional responsibilities in the country risk field.

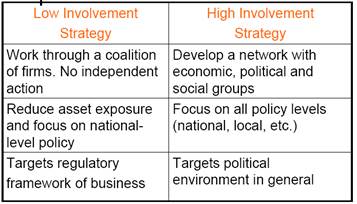

53. What are the basic strategies to manage political risk?

54. How should international managers minimize the political risk?

Use extensive local debt

Governments are less likely to harass business if it might lead to a default on local debt and put their banking system at risk.

For foreign debt, finance operations via a consortium of lenders from different countries

Gain support of several foreign governments in protecting your business (used for very large capital projects, such as natural gas exploration and development).

Use project financing (i.e. output guarantees the loan)

This makes nationalization less attractive because income must be used to pay down debt.

55. How does the political environment affect the economy?

Economic risk arises from such uncertainties as change in cost or demand or competition in the marketplace.

56. How does the legal environment affect international business? How should the international managers address the various legal challenges in different countries?

A domestic firm must follow the laws and customs of its home country.

An international business faces a more complex task: It must obey the laws not only of its home country but also of all the host countries in which it operates. The laws of both the home and the host countries can affect directly and indirectly the international companies and the way they conduct their business. These laws determine the markets the firms serve, the cost of goods and/or services they offer, the price they charge, and costs for labor, raw materials, and technology.

In addition to understanding the politics and laws of both home and host countries, the international manager must consider the overall international political and legal environment. International law plays an important role in the conduct of international business. Although there is no body to enforce international law, certain treaties and agreements are respected by a number of countries and influence international business operations. The World Trade Organization (WTO) is such an international agency that defines internationally acceptable economic practices for its member countries. There are many other agreements that provide some legal regulation of international commerce, including the EU, North American Free Trade

Agreement (NAFTA), and others.

57. What ways are there in resolving international disputes?

58. What are the differences between Common, Civil, and Theocratic Law? How do international managers deal with these different types of laws?

One important difference between common law and civil law systems is apparent in the role of judges and lawyers. In a common law system the judge serves as a neutral referee, ruling on various motions by the opposing parties’ lawyers. These lawyers are responsible for developing their clients’ cases and choosing which evidence to submit on their clients’ behalf. In a civil law system, the judge takes on many of the tasks of the lawyers, determining, for example, the scope of evidence to be collected and presented to the court. Common law is based on the court’s interpretation of events, whereas civil law is based on how the law is applied to facts. An example of an area in which the two systems differ in practice is contracts. In a common law country, contacts tend to be detailed, with all contingencies spelled out. In a civil law country, contracts tend to be shorter and less specific because many of the issues that a common law contract would coverare already included in the civil code. Thus, when entering into contracts abroad, it is important for the manager to understand which type of legal system will establish the contract. Civil law also tends to be less adversarial than common law because judges rely on detailed legal codes rather than on precedent when deciding cases. This is one reason why British and US law firms encounter so much resistance when they enter civil law countries. They are used to the competitive, adversarial approach that the common law system engenders.

59. What is corruption and how does it affect international business?

Consensus now exists that corrupt behavior reduces economic growth and can destabilize governments. Corruption erodes respect for the law and deters honest people from entering public service. It results in over-invoicing and substandard work by contractors and reduces tax revenues. Corruption also undercuts environmental regulations and building code regulations, discourages foreign direct investment in developing countries, and facilitates other crimes, such as drug trafficking. Corruption—broadly defined as “the abuse of public or private office for personal gain”14—takes many different forms, from routine bribery or petty abuse to the amassing of spectacular personal wealth through embezzlement or other dishonest means.

60. What is bribery and how is it being addressed by international agencies?

Between 1994 and 2001 the US government received reports of 400 international cases worth US$200 billion signed between governments and businesses worldwide that purportedly involved bribery Between May 2001 and April 2002 alone, the US government learned of 60 contracts worth a total of US$35 billion that had been affected by bribery.17 Some 70 percent of the allegations that the US government received in 2000–2001 involved companies from countries that had signed the Organization for Economic Cooperation and Development’s (OECD’s) 1997 anti-bribery Convention. Corruption scandals in the 1990s (in France, Brazil, Japan, Pakistan, and elsewhere) demonstrated that corruption is widespread, even in democracies. In recent years, government leaders and nongovernmental organizations have developed a variety of strategies to expose corruption and counter its effects. Transparency International, a global organization with chapters, builds anticorruption coalitions with governments, business people, and representatives of civil society. The World Bank and the International Monetary Fund focus on introducing reforms in developing countries to address the demand side of bribery. In cases where a country has high levels of corruption and a government that is not instituting reforms, international financial institutions may reduce or eliminate aid. In 1996 the UN General Assembly approved a code of conduct for public officials and called on member states to make the bribing of public officials a crime. Corruption reform programs have been successful in exposing government bribery by conducting national surveys and by publishing “report cards” that detail specific instances of corruption. “Big Mac Indexes, ” which reveal suspicious cost differences in a country for similar commodities, such as a school lunch or a bottle of aspirin, can be especially effective. As an example, Transparency International/Argentina conducted a Big Mac survey, which revealed that a school lunch in Buenos Aires cost the equivalent of $5. A comparable lunch in Mendoza, which had been implementing anticorruption measures, cost the equivalent of 80 cents. Within days of publication of the survey’s results, the cost of a school lunch in Buenos Aires was more than halved. World Bank research, meanwhile, shows that one third (35 percent) of foreign companies operating in the countries of the former Soviet Union pay kickbacks to obtain government contracts, of which US and European companies are among the worst offenders. Despite US anticorruption legislation, 20 42 percent of US companies reported paying bribes in these countries, compared to 29 percent of French firms, 21 percent of German firms, and 14 percent of British ones.21 In those countries with particularly high levels of corruption, meanwhile, over 50 percent of multinationals admitted to paying public procurement kickbacks.

|

|