Главная страница Случайная страница

Разделы сайта

АвтомобилиАстрономияБиологияГеографияДом и садДругие языкиДругоеИнформатикаИсторияКультураЛитератураЛогикаМатематикаМедицинаМеталлургияМеханикаОбразованиеОхрана трудаПедагогикаПолитикаПравоПсихологияРелигияРиторикаСоциологияСпортСтроительствоТехнологияТуризмФизикаФилософияФинансыХимияЧерчениеЭкологияЭкономикаЭлектроника

Principles of insurance

|

|

All insurance is governed by certain principles.

1) A person can only insure an event which will cause a personal or monetary loss.

2) Person taking out insurance must not tell lies or omit to mention relevant facts which might affect the insurer’s decision about whether to issue a policy or what premium to charge.

3) lf a claim is made the insured person should be restored to the same position he or she was in before the event. Nobody can make a profit out of insurance. No one must encourage damage in order to get money.

* Lloyds’ Shipping Index – реєстр Ллойдз; перелік морських суден, що видається компанією Ллойдз

III. Answer the following questions:

1. What risks do businessmen face in export trade?

2. How do exporters protect themselves against possible risks?

3. What is the essence of insurance?

4. What does the word ‘average’ mean in the insurance business?

5. What information is given in the insurance policy?

6. What does the insurance premium depend on?

7. How did the term ‘underwriter’ originate?

8. When and how was Lloyds of London established?

9. What services does the modern Corporation of Lloyds provide?

10. What are the main principles of insurance?

IV. Give Ukrainian equivalents of the following:

to insure goods for the full value; to take a risk; to be covered by insurance; burglary; breakage; leakage; to be insured a.a.r.; the amount of insurance charge; up-to-date information; to take out insurance; to make a claim; to encourage damage.

V. Give English equivalents of the following:

отримувати відшкодування; не боячись катастрофічних збитків; на кожному етапі перевезення; страхувати на випадок загальної чи часткової аварії; умови комерційного контракту; рух вантажів; керуватись певними принципами; пропускати (не згадувати); бути відновленим в тому ж самому стані; скарга (претензія).

VI. Match the definition on the right with the word on the left. Translate and learn the definitions:

| to ensure | a) possibility or chance of meeting danger, suffering loss, etc. |

| to underwrite | b) to make a contract that promises to pay a sum of money in case of accident, damage, loss, death, etc. |

| damage | c) safeguard against loss |

| insurance | d) to take responsibility for all or part of possible loss (by signing an agreement about insurance, esp. of ships) |

| risk | e) harm or injury that causes loss of value |

VII. Fill in the gaps with the words from the list below:

reimbursement, insured a.a.r., to compensate, insurance, damaged

1. We now have all our consignment ….

2. They were sorry to hear that part of goods had been ….

3. The insurance company agreed … the incurred losses.

4. When taking out … don’t forget to mention all relevant facts.

5. … helped to restore his business in the shortest time possible.

VIII. Match the synonyms. Use any 5 words in the sentences of your own:

| 1) indemnity | a) insurer |

| 2) underwriter | b) loss |

| 3) average | c) reimbursement |

| 4) burglary | d) cover |

| 5) insure | e) pilferage |

| 6) vessel | f) transportation |

| 7) shipping | g) ship |

IX. Match the words with the opposite meaning. Use any 5 words in the sentsnces of your own:

| 1) general | a) obsolete |

| 2) restore | b) profit |

| 3) up-to-date | c) damage |

| 4) lie | d) particular |

| 5) loss | e) truth |

X. Which of these words does not belong to the following groups? Make up sentences with the given word combinations:

| policy | theft | ||

| insurance | certificate | to insure against | burglary |

| premium | pilferage | ||

| consignment | strike |

| to incur | to cover | ||

| to sustain | losses | to compensate | damage |

| to suffer | to reimburse | ||

| to examine | to arrange |

XI. Translate into English:

1. Наша страхова премія була збільшена.

2. При загальній аварії збитки поділяються між усіма вантажовідправниками, що користуються тим же судном у тому ж рейсі.

3. Ця компанія готова відшкодувати збитки і замінити пошкоджений товар.

4. Оскільки ми понесли значні збитки від часткових аварій в минулому році, тепер ми страхуємо наші вантажі від усіх можливих ризиків.

5. Коли ви висловили претензію до цієї страхової компанії?

6. Страховий поліс разом з іншими транспортними документами надсилається до банку.

XII. Topics for discussion:

1) Speak about the possible risks in export trade.

2) Insurance as an essential part of the contract of sale.

3) Lloyds of London and its activities.

XIII. Skills practice:

Assignment 1. Look through the following letters. Define the problem discussed and its solution.

Letter 1

Dear Sirs,

We received your consignment on 15th December. Our agent noticed that the cases 9, 10 and 11 were broken. It looks as if some heavy object was dropped on these cases. We opened the cases completely and contacted the Lloyd’s surveyor. He is examining the damage at the moment and no doubt will send his detailed report as soon as possible.

You hold the insurance policy. We would be obliged if you would take up the matter with the insurers. The Insurance Certificate number is As/26241. Do you want us to send the certificate to you?

With best wishes…

Letter 2

Dear Sirs,

Thank you for your letter of 18th December. We are sorry to hear that the part of goods was damaged. We have checked the packing list for cases 9, 10 and 11 and we have arranged to send replacement in the nearest future.

It will not be necessary to send the Certificate of Insurance. We hold a floating policy covering our consignment against all risks, but excluding war risks. We used to insure free of particular average but since we incurred a considerable number of particular average losses, we now have all our consignment insured a.a.r.

We trust these arrangements are to your satisfaction.

Yours faithfully…

Assignment 2. Find in the letters above information concerning insurance. What made the exporter switch from f.p.a. insurance to a.a.r. insurance?

Unit Eleven

Means of payment in foreign trade

I. Read and learn the following words and word combinations. Translate the examples:

payment n – 1) платіж, оплата; 2) погашення (боргу); 3) внесок; 4) винагорода; means of payment – засіб платежу; syn. instrument of payment – платіжний інструмент; method of settlement – форма оплати/розрахунку/ погашення боргу

payer n – платник

payee n – одержувач грошей, ремітент

payable adj – той, що підлягає оплаті; оплачуваний; payable on demand – оплачуваний по вимозі, на пред’явника

e.g. Means of payment is the instrument of payment where certain instructions are written.

сash n – 1) готівка, готівкові гроші; 2) банкноти, монети та ін. активи, що прирівнюються до готівки; 3) готівкові угоди

e.g. Cash in the form of coins and notes is rarely used in foreign trade.

cheque n (A.E. check) – чек; to cash a cheque – отримати готівку по чеку; to negotiate a cheque – переуступити чек; open cheque –відкритий чек; negotiable cheque – обіговий/оборотний, передатний чек; cheque book – чекова книжка

e.g. Payments of large sums of money are usually made by cheque.

draw v – виписувати/виставляти тратту, чек;

drawer n – особа, що виписує чек/виставляє тратту; трасант

drawee n – особа, на яку виписано чек/виставлена тратта; трасат

to draw on (smb) for – виставити вексель (на когось) на (суму)

e.g. A person drawing the cheque is called a drawer.

сross v – перекреслювати, кроссувати; cross/crossed cheque – кроссований чек; crossing n – кроссування чека; general crossing – загальне кроссування; special crossing – особливе кроссування

e.g. The crossing is two parallel lines placed across the cheque.

due date – строк оплати, термін погашення

Bill of Exchange – перевідний вексель, тратта; sy n. draft, transfer note; documentary Bill of Exchange – документований вексель; the face of the bill – лицьова сторона чека; sight draft/bill – вексель/тратта на пред’явника; term draft/bill – терміновий, строковий вексель/тратта

e.g. Bill of Exchange is often called a draft, especially if payment is made from one bank to another.

аccept v – 1) приймати, погоджуватись; 2) акцептувати (вексель); accepted – акцептований; accepted cheque – акцептований чек

acceptor n – акцептант

acceptance n – акцептований вексель, тратта

e.g. The drawee becomes acceptor after he has accepted the bill.

II. Read and translate the text:

Means of Payment in Foreign Trade

Means of payment (also called method of settlement) is the instrument by which payment is made. Among numerous instruments we distinguish between payment in cash, by cheque (A.E. check), bank transfer, SWIFT, draft, bank money order, telegraphic transfer (TT), mail transfer (MT), Bill of Exchange. Generally speaking, means of payment is the instrument of payment where certain instructions are written.

The simplest way is to pay in cash that is money in coins or notes. This, however, is very rarely used in foreign trade. A cheque is a written order by a person (a drawer) to a bank (a drawee) to pay a certain sum of money from the person's bank account to another person (a payee). Payments of large sums of money are usually made by cheque rather than cash and the drawer of the cheque will wish to make sure the cheque does not fall into wrong hands.

A cheque made out as payable on demand (an open cheque) can be cashed or negotiated by any person who holds it. To minimize such a possible loss it is usual to cross the cheque. A crossed cheque can only be paid into a bank account. The crossing is two parallel lines placed across the cheque with or without the words “not negotiable” or “a.c.” – “payee only” or “and company”. This is called a general crossing. A special crossing is the one where the words are added to general crossing specifying the bank at which the cheque is to be presented.

A Bill of Exchange is an unconditional order in writing addressed by one person to another and signed by the person giving it, requiring the person to whom it is addressed to pay on demand (a sight draft) or at a fixed or determined future date (a term draft) a certain amount of money to a specified person or to the bearer. A Bill of Exchange is sometimes called a draft, especially if payment is made from one bank to another. It is often used in foreign trade. The buyer signs an agreement to pay on the due date by writing across the face of the bill the word “accepted” together with his name and the name of his bank, where the amount will be paid. The terms of payment of the bill may be 50, 60, 90 days after sight (D/S). In some countries three extra days are allowed for payment. They are called “days of grace”.

The person drawing the bill is called the drawer, the person upon whom it is drawn (to whom it is addressed) is called the drawee, who becomes acceptor after he has accepted the bill. Here is an example of the Bill of Exchange.

| $ 580.57 Due 11th May, 2003 London 8th February, 2003 STAMP Three months after date, pay to our order the sum of five hundred and eighty dollars and fifty seven cents for value received. To Messrs. A. White & Co For and behalf of Smith & Co., Ltd. (Signatures)_________________ |

If the drawee is willing to pay, he signs across the face of the bill:

Accepted

Payable at

The Sheffield City Bank

A.White & Co.

When payment is made through a post office (which does not very often happens in international trade) money orders are used, either TT or MT.

The credit card is becoming a very important means of payment in consumer transactions and is replacing the cheque in the everyday payments. It first appeared in the USA and is now spreading throughout the world. The best known credit cards in use are Barclay Cards, Access Cards, Diners Club Cards;, American Express Cards, Eurocard/Mastercard, Visa Cards. A special kind of credit card is the cheque card.

III. Answer the following questions:

1. What means of payment are used in trade transactions?

2. Why is cash rarely used in foreign trade?

3. What is a cheque?

4. How are cheques protected against possible loss?

5. What do we call ‘crossing’?

6. What is a Bill of Exchange?

7. Who is the drawer?

8. What is the difference between a sight draft and a term draft?

9. What should the drawee do if he agrees to pay?

10. What are the usual terms of payment of the bill?

11. What means of payment replaces cash in everyday payments?

IV. Give Ukrainian equivalents of the following:

a certain sum of money; to fall into wrong hands; a cheque… can be cashed or negotiated; a determined future date; after sight; for and behalf of; consumer transactions; by cheque rather than cash; extra days

V. Give English equivalents of the following:

засіб розрахунків; письмове розпорядження; оплачуваний на пред’явника; безумовне розпорядження; вказана особа; строк платежу; виставити тратту; акцептувати; пільгові дні; 30 днів після пред’явлення; угоди споживачів

VI. Study the following expressions. Use them in the sentences of your own:

to draw/ to issue/ to make out/ to write out a cheque – виписувати чек

to cash/ to collect/ a cheque – отримувати гроші по чеку

Use the given expressions to define the following:

A drawer is a person who…

A payee is …

VII. Match the definition on the right with the word on the left. Learn the definitions:

| bearer | a) money in coins or notes, money in any form |

| bill | b) to write out a cheque |

| cash | c) written statement of charges for goods delivered or services given |

| to draw | d) to get or give money for cheques, etc. |

| to negotiate | e) a person who presents a cheque to the bank |

VIII. Fill in the gaps with the words from the list below:

on demand, to cross, cash, means of payment, due, at sight

1. You may draw on them for Hr 1000 … through the Eximbank.

2. You may … your traveller’s cheques at any bank.

3. The bill is called a sight draft if it is made out payable ….

4. To avoid possible loss it is usual … the cheques.

5. This Bill of Exchange is … on March, 20th.

6. Nowadays credit cards have become a convenient ….

IX. Match the synonyms. Use any 5 words in the sentences of your own:

| 1) method of settlement | a) at sight |

| 2) on demand | b) determined |

| 3) specified | c) means of payment |

| 4) bearer | d) demand |

| 5) require | e) holder |

X. Match the words with opposite meaning. Use any 5 in the sentences of your own:

| 1) across | a) often |

| 2) minimize | b) refuse |

| 3) written | c) along |

| 4) rarely | d) maximize |

| 5) accept | e) oral |

XI. Translate into English:

1. Форма оплати залежить від умов, які були узгоджені в контракті.

2. Термін сплати цього векселя наступає 15 вересня, враховуючи пільгові дні.

3. Ми проводимо цю зустріч від імені та за дорученням голови банку.

4. Чек підлягає оплаті протягом 3 днів.

5. Оплата готівкою все рідше застосовується в повсякденних фінансових операціях.

6. Ми можемо перерахувати (перевести) гроші тільки на ваш банківський рахунок.

XII. Topics for discussion:

1) Speak about means of payment used in everyday consumer transactions.

2) Cheque, its essence and the ways to safeguard it.

3) Bill of Exchange, its essence, the terms of its payment.

XIII. Skills practice:

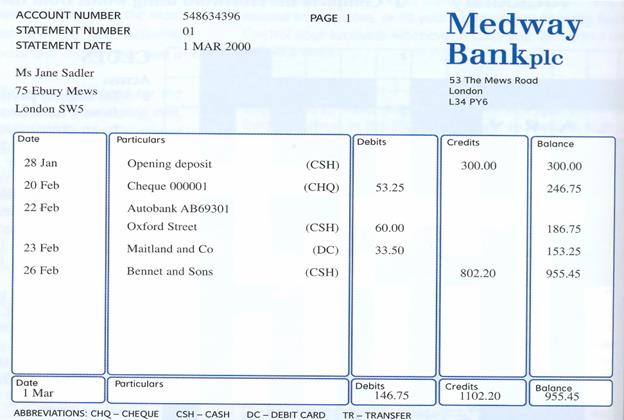

Assignment 1. Complete the passage using words from the box and the information in the bank statement below.

| credit account cash transactions payment balance deposit cheque debit debit card |

| Jane Sadler opened her _____ with the Medway Bank on 28th January with a cash ______ of £ 300. On 15th February she wrote a ______ for £ 53.25 and this appeared as a ______ on the bank statement on 20th February. On 22nd February she took out £ 60 in ______ from a cashpoint machine. On the following day the bank debited £ 33.50 from her account for a ______ she had made using her ______. Her monthly salary was paid directly into her account and this appeared as a ______of £ 802.20 on 26th February. There were no further ______ on her account and she finished the month with a ______ of £ 955.45. |

|

Assignment 2. Look through the text about Western Union. Find information concerning: - location; - working hours; - reliability; - system operation.

International Money Transfer. Western Union

Through Western Union, anyone can send or receive money internationally for any reason – and no credit card, bank account or membership is needed. More people use Western Union than any other money transfer service to support family back home, rescue travelers in emergencies, aid students in foreign countries, and keep businesses operating smoothly.

Receivers can pick up their money just minutes after it is sent. Western Union uses modern electronic technology and its own worldwide computer network to issue immediate payout authorization in more than 100 countries.

Western Union has been safely transferring money since 1871. Every transfer is protected by our world-class security system. This ensures that your money will be paid out only to the right person.

Western Union is the world’s largest money transfer network, with more than 28, 000 agent locations dedicated to the highest levels of customer service. Many are in banks, post offices, pharmacies, stores, railway stations, airports, and other convenient places, and are open for early and late hours and on weekends.

The sender brings the money to any Western Union agent, fills out a short form, pays the service fee and receives a receipt with a Control Number. The sender then informs the receiver of the transfer. The receiver goes to any Western Union agent, provides identification (knowing the Control Number will help, but is not necessary), and immediately gets the full amount in cash.

Friendly Western Union operators in every country we serve can answer your questions and help you locate the most convenient agents. All operators speak English as well as their national language.

Unit Twelve

Methods of payment in foreign trade

I. Read and learn the following words and word combinations. Translate the examples:

security n – 1) безпека; 2) захист, охорона; 3) забезпечення, гарантія; syn. safety, safeguard; securities – цінні папери; syn. stock; stock exchange – фондова біржа; біржа цінних паперів; to provide security – забезпечувати захист; as a safeguard (against) – в якості гарантії (на випадок)

secure adj – захищений, безпечний, гарантований; syn. safe

e.g. Basic methods of payment provide various degrees of security for the importer and the exporter.

e.g. Securities are traded at the Stock Exchange.

payment in advance – оплата авансом; передоплата; syn. cash with order – готівка з замовленням

e.g. Our only term is payment in advance.

credit n – 1) довіра; 2) кредит; opp. debit 3) акредитив; to extend credit – надавати кредит; Documentary Letter of Credit (L/C) – документарний акредитив; debit and credit – дебет і кредит; credit card – кредитна картка; debit card – дебетна картка

e.g. The documentary letter of credit is a reliable and safe method of payment.

release v – 1) звільняти; 2) дозволяти (випуск, видачу, відвантаження, публікацію); 3) випускати нову продукцію; 4) випускати в продаж; 5) публікувати

e.g. Goods will be released only after payment of the invoice

account n -1) рахунок; 2) фінансовий звіт; 3)pl. звітність, бухгалтерські рахунки; bank/banking account – банківський рахунок; current/checking (A.E.) account – поточний рахунок; open account – відкритий рахунок; to account for – 1) пояснювати; 2) звітувати; відповідати; нести відповідальність

e.g. Payment on open account offers the least security to an exporter.

recover v – 1) повертати; 2) відшкодовувати, покривати; 3) збирати (борги), інкасувати; to recover money – отримати назад гроші; recovery – 1) повернення, відшкодування; full recovery – повне відшкодування; 2) economic recovery – економічний підйом

e.g. There exist legal procedures for recovering money against bill of exchange.

collection n – 1) збір, збирання; 2) грошовий збір; 3) інкасо; 4) отримання грошей (по векселю, чеку); for collection – на (через) інкасо

e.g. We shall send the documents to our bank for collection in 3 days.

revoke v – 1) скасовувати, анулювати; 2) відкликати, повертати

revocable adj – відкличний, поворотний; opp. irrevocable – безвідкличний, безповоротний; той, що не підлягає скасуванню

e.g. Documentary Letter of Credit may be revocable or irrevocable.

in somebody’s favour – на чиюсь користь, на чиєсь ім’я

issue v – 1) випускати в обіг; емітувати; 2) виписувати, видавати, виставляти; the issuing bank – банк-емітент

issue n – предмет обговорення, дискусійне питання

e.g. The importer asks his bank to issue a documentary credit in the exporter’s favour.

advise v – 1) радити, рекомендувати; 2) консультувати; 3) повідомляти, авізувати; “advise fate” – „інформуйте про долю” (форма звертання одного банку до іншого щодо оплати рахунку)

adviser n – радник, консультант; economic/financial/trade adviser; the advising bank – авізуючий банк

e.g. The issuing bank arranges with the advising bank to pay the exporter after the examination of the documents.

II. Read and translate the text

Methods of Payment in Foreign Trade

Compared to selling in the domestic market, selling abroad can create extra problems. Delivery generally takes longer and payment for goods can take more time. So exporters need to take extra care in ensuring that prospective customers are reliable payers and payment is received as quickly as possible. Payment for export depends on the conditions outlined in the commercial contract with a foreign buyer. There are internationally accepted terms designed to avoid confusion about costs and price (Incoterms). The way exporters choose to be paid depends on a number of factors: the usual contract terms adopted in the buyer's country; what competitors may be offering; how quickly funds are needed; the availability of foreign currency to the buyer and, of course, whether the cost of any credit can be afforded by the importer (the buyer) or the exporter (the seller).

There are several basic methods of payment providing various degrees of security for the exporter and the importer.

Payment in advance (Cash with order)

The best possible method of payment for the exporter is payment in advance. Cash with order (CWO) avoids any risks on small orders with new buyers and may even be asked before the production begins. However this form is rare since it means that the buyer is extending credit to an exporter. In addition the importer may run a risk that the goods will not be despatched in accordance with the contract terms. Nevertheless, provision for partial advance payment in the form of deposits (normally between 10 per cent and 20 per cent of the contract price) or progress payments at various stages of manufacture is often included in the contract terms.

Variation of this form is cash on delivery (COD), where small value goods are sent by Post Office parcel post and are released only after payment of the invoice plus COD charges.

Open account

Payment on open account offers the least security to an exporter. The goods and accompanying documents are sent directly to the importer who has agreed to pay within a certain period after the invoice date – usually not more than 180 days. There are various ways in which the importer can send money to his supplier under open account and he may wish to choose the means to be used, for example payment by cheque, by telegraphic transfer (TT), by International Money Order, etc.

The open account method is increasingly popular within the EEC because it is simple and straightforward.

Documentary Bill of Exchange

This is a popular method as it offers benefits for both the exporter and the importer. The main advantage for the importer is that he does not need to make payment until his exporter has dispatched the goods. The advantage for the exporter is that there are legal procedures for recovering money against bill of exchange and, if the goods are sent by sea, he is able to control them through the documents of title to the goods until the importer has agreed to make payment. Documentary bill of exchange is a demand for payment from the exporter. He will draw it up on a special printed form and forward it to his bank together with the documents relating to the transaction. These may include the transport document proving that the goods have been dispatched. The exporter’s bank will send the bill and documents to the importer’s bank “for collection”. The importer’s bank will notify him of the arrival of the documents and will release them to the importer provided that: a) he pays the amount of the bill in full if it is the sight draft, or b) if the bill is a term draft, the importer “accepts” it, i.e. signs across the bill his agreement to pay the amount in full on the due date.

Documentary Letter of Credit (L/C)

The Irrevocable Letter of Credit is the most commonly used method of payment for imports. The exporter can be sure that he will be paid when he dispatches the goods and the importer has proof that the goods have been dispatched according to his instructions.

The “letter” is an inter-bank communication. The two banks take full responsibility that both shipment and payment are in order. The banks deal only in documents and are not obliged to inspect the actual goods. This is how the system works.

4 The importer and exporter agree a sales contract and the terms of the Documentary Credit.

4 The importer asks his bank to open a Documentary Credit in the exporter’s favour.

4 The importer's bank (the issuing bank) issues a L/C saying, “We, the bank, promise that we will pay you when you submit certain documents that prove that you have shipped the goods as agreed upon in the sales contract”. The L/C specifies the documents to be submitted, the shipping requirements and the expiry date. The issuing bank sends a L/C to a bank in the exporter's country (the advising bank). The issuing bank arranges with the advising bank to pay the exporter after the documents have been presented.

4 The exporter prepares the documents, usually an invoice, a bill of lading, an insurance policy, a packing list and a certificate of origin, then makes a shipment. Then the exporter draws a draft (Bill of Exchange), attaches the documents to it and presents everything to the advising bank for payment.

4 The advising bank examines the documents. If everything is in order the bank pays the draft presented by the exporter and sends the documents to the issuing bank.

4 The issuing bank notifies the importer that the documents are at his disposal. The bank releases the documents as soon as the importer has paid and the importer may receive the goods.

There is a great variety of international trade relations, so there are different kinds of L/C. But all have the same function: to provide a safe and trusted method of payment between importer and exporter.

III. Answer the following questions:

1. What factors influence the choice of the methods of payment in foreign trade?

2. How do basic methods of payment differ?

3. Which of the methods of payment is the most secure for the exporter?

4. Why is CWO rarely used?

5. Which of the methods of payment is the least secure for the exporter?

6. What benefits does payment by documentary bill of exchange offer to the exporter? to the importer?

7. What is the role of the bank in dealing with the documentary bill of exchange?

8. What method of payment is the most commonly used in foreign trade and why?

9. How are banks involved in payment by documentary L/C?

10. What are the obligations of the importer/exporter in this kind of payment transaction?

IV. Give Ukrainian equivalents of the following:

prospective customer; conditions outlined in … contract; to afford the cost of credit; nevertheless; to be increasingly popular; simple and straightforward; documents of title to the goods; to forward; to notify; on the due date; actual goods; at his disposal.

V. Give English equivalents of the following:

внутрішній ринок; вжити додаткових заходів безпеки; щоб уникнути непорозумінь; поетапна оплата; супроводжуючі документи; юридична процедура; друкований бланк; за умови, що...; сплатити суму повністю; міжбанківський обмін інформацією; конкурент

V. Learn the following phrases with the word “account”. Use them to translate the following sentences:

to establish/to open an account with the bank – відкрити рахунок в банку

to have/to keep an account with the bank – мати рахунок в банку

to draw money from an account – знімати гроші з рахунку

to overdraw an account – зняти більше грошей, ніж є на рахунку; перевищити залишок на рахунку

to pay into/to enter to an account – зараховувати (суму) на рахунок

to transfer to an account – перерахувати (суму) на рахунок

to settle an account – 1) оплачувати рахунок; 2) узгоджувати суму на рахунку

to close an account – закривати рахунок

1. Кожна особа може відкрити рахунок в банку.

2. Нам потрібно перерахувати гроші на вказаний рахунок.

3. Будьте уважні не перевищуйте залишок на поточному рахунку, інакше банк може анулювати ваші чеки.

4. В якому банку ти маєш рахунок?

5. Перш ніж закрити рахунок, ви повинні узгодити суму на ньому.

6. Це дуже дорога річ. Щоб купити її, тобі доведеться зняти гроші з рахунку.

7. Будь ласка, зарахуйте цю суму на мій рахунок.

VII. Match the definition on the right with the word on the left. Learn the definitions:

| credit account | a) pay money before the due date |

| advance | b) get back (smth lost, etc.) |

| recover | c) account with a shop, etc. with an agreement for payments at a later date, e.g. monthly or quarterly |

| advantage | d) written order for payment of money by a bank; drawing of money by means of such an order |

| draft | e) smth useful, helpful or likely to bring success, esp. in competition |

VIII. Fill in the blanks with the words from the list below:

forward, arrangements, draw, irrevocable, advance

1. The … L/C cannot be cancelled, so the exporter can be sure to collect his money.

2. On receipt of your documents we shall … your order.

3. The suppliers asked the importer for 20% ….

4. You may … on us at 90 days from the date of dispatch.

5. Please, inform what … you have made for payment.

IX. Match the synonyms. Use any 5 words in the sentences of your own:

| 1) competitor | a) trust |

| 2) security | b) give out |

| 3) notify | c) reimburse |

| 4) release | d) safeguard |

| 5) recover | e) rival |

| 6) credit | f) inform |

X. Match the words with the opposite meaning. Use any 5 words in the sentences of your own:

| 1) lose | a) deliver |

| 2) dispatch | b) departure |

| 3) arrival | c) unreliable |

| 4) in addition | d) recover |

| 5) trusted | e) except |

XI. Translate into Ukrainian:

1. Постачання закордон та оплата товару займають більше часу, ніж операції на внутрішньому ринку.

2. Перш ніж надати кредит переконайтесь, що ваш партнер – надійний платник.

3. Які супроводжуючі документи я повинен надати банку?

4. Ви отримаєте гроші по векселю при умові, що всі документи в порядку.

5. Умови транспортування уточнені в акредитиві.

6. Оскільки він був новим клієнтом, фірма попросила часткову передоплату замовлення.

XII. Topics for discussion:

1) Speak about the degrees of security offered by payment in advance, payment on open account; by B/E; by L/C.

2) Explain the essence of payment by B/E.

3) Explain the essence of payment by L/C.

XIII. Skills practice:

Assignment 1. Complete the scheme, showing the relations between the participants.

| Sales Contract |

| Exporter/Seller |

| Importer/Buyer |

Goods Money

| The advising bank | B/E L/C | The issuing bank |

Assignment 2. Explain the scheme, the movement of goods and money.

Assignment 3. Look at the following document - a copy of a letter of credit. Read the explanation of the various sections on the next page and decide which explanation goes with which number.

Most Credits are fairly similar in appearance and contain the following details:

· The terms of contract and shipment (i.e. whether ‘ex-works’, ‘FOB’, ‘CIF’, etc).

· The name and address of the importer (accreditor).

· Whether the Credit is available for one or several shipments.

· The amount of the Credit in sterling or a foreign currency.

· The expiry date.

· A brief description of the goods covered by the Credit (too much detail should be avoided as it may give rise to errors which can cause delay).

· The name and address of the exporter (beneficiary).

· Precise instructions as to the documents against which payment is to be made.

· The type of Credit (Revocable or Irrevocable).

· Shipping details, including whether transhipments are allowed.

· Also recorded should be the latest date for shipment and the names of the ports of shipment and discharge. (It may be in the best interest of the exporter for shipment to be allowed 'from any UK port’ so that he has a choice if, for example, some ports are affected by strikes. The same applies for the port of discharge.)

· The name of the party on whom the bills of exchange are to be drawn, and whether they are to be at sight or of a particular tenor.

Assignment 4. Describe the exporter’s/importer’s obligations under the contract.

Unit Thirteen

Barriers to international trade

I. Read and learn the following words and word combinations. Translate the examples:

consume v – споживати

consumer n – споживач; ultimate/final consumer – кінцевий споживач consumerism n – захист споживача

consumption n – 1) споживання; 2) затрати; personal/private/individual/household consumption – особисте споживання; public consumption – споживання для задоволення потреб населення; social consumption – суспільне споживання; per capita consumption – споживання на душу населення; world consumption – світове споживання; yearly consumption – річне споживання

e.g. Per capita consumption has increased in recent years.

commodity n – 1) предмет споживання, товар; 2) продукт; consumer/consumable commodities – товари широкого вжитку; export/import commodities – експортні/імпортні товари; essential commodities – товари першої необхідності; commodity in short supply – дефіцитний товар; syn. goods

e.g. Our company trades in consumer commodities.

prohibit v – 1) забороняти; 2) заважати, перешкоджати; syn. to ban, to restrict, to veto; prohibited imports – товари, заборонені до ввезення

e.g. Embargo prohibits all trade with a particular country.

measure n – 1) міра, система мір; 2) критерій, мірило, масштаб; 3) захід, засіб; economy measures – економічні заходи; punitive measures – каральні заходи

e.g. The government used every measure to protect home producers of steel.

administrative red tape – адміністративні бюрократичні заходи

e.g. Administrative red tape is often used to restrict foreign trade.

regulation n – 1) регулювання; 2) правилa, інструкції, приписи, регламент; 3) постанова, розпорядження

e.g. All countries have regulations about standards for products.

abolish v – 1) відміняти; 2) знищувати; syn. to eliminate

e.g. Countries should abolish non-tariff restrictions on foreign trade.

goal n – 1) мета; 2) завдання; syn. aim, purpose, objective; primary goal – першочергова мета/завдання

e.g. The primary goal of GATT was to control restrictions on foreign trade.

dumping n – демпінг

e.g. Selling the same product for a lower price abroad than at home is called dumping

II. Read and translate the text:

Barriers to International Trade

Despite the many advantages of trade between nations trade barriers are often imposed on certain goods. You have already learned some general information about the means of controlling foreign trade (see Units 2-3). Here we shall dwell upon these issues in more details.

Two of the most important barriers to trade (import) are tariffs and quotas. A tariff is a duty, or tax, usually levied on imported goods. It is imposed to make imported goods more expensive compared to the domestic product. For this reason tariffs are usually very high and discourage the import of lower-priced foreign goods to the country.

Quotas are physical limits upon the amount of a good or a service, which can be imported or exported. Products limited by quotas may be subject to tariff as well. However quotas tend to increase prices even more than tariffs. Quotas are often used to restrict imports where tariffs seem to be not very effective because consumers are prepared to pay high prices for foreign commodities. Like protective tariffs quotas limit the amount of foreign competition a protected home industry is likely to face. For example, a quota may state that not more than X automobiles may be imported from a definite country in one year, thus protecting home automobile industry.

A specific type of quota that prohibits all trade is known as an embargo. It is a complete ban upon trade with a particular country. Like quotas embargos may be imposed on either imports or exports. Embargo is usually imposed for political reasons but also has an economic effect. The USA has maintained embargo on Cuban goods since 1959, when Castro took power in Cuba. This embargo severely damaged Cuban sugar industry and caused nearly $86 billion losses for Cuban foreign trade in almost 50 years.

A boycott is a restriction against the purchase of goods from a particular country aimed at protecting domestic industries. Sometimes boycotts are used as a punitive measure to restrict both imports and exports between two countries

There are other devices that directly influence the flow of trade among nations. One of these is the export subsidy – a payment by a country to its exporters that enables them to sell their products abroad at a lower price than they could sell them for at home. Selling the same product for a lower price abroad than at home is called dumping. Such policy allows the exporters to penetrate foreign markets and face the competition while all their expenses are compensated by the government subsidies.

Still another tactic to restrict foreign trade can be classified as “administrative red tape”. This is the use of governmental rules and regulations to make it difficult to import goods from abroad. All countries have regulations about standards for products. They are aimed to protect health, safety and product quality. Occasionally product standards can be deliberately designed to prevent imports.

Since the Second World War countries have attempted to abolish or at least to control restrictions on trade. One of the most important steps was signing the General Agreement on Tariffs and Trade in 1948. The primary goal ofGATT was 1) to reduce protectionism that favours home producers over foreign producers and 2) to eliminate discrimination favouring one foreign producer over another. According to the principles of GATT protection should only be given through tariffs while such non-tariff restrictions as import quotas or subsidies should be discouraged.

III. Answer the following questions:

1. How do import tariffs influence the price of goods?

2. In what case are quotas imposed?

3. What are the reasons for imposing an embargo?

4. What is the aim of a boycott?

5. How do subsidies influence foreign trade?

6. What is called dumping?

7. In what forms can administrative red tape be used?

8. With what purpose are product standards introduced?

9. What post-war event was the first step to control restrictions on foreign trade?

10. How should a country protect its home industry according to the principles of GATT?

IV. Give Ukrainian equivalents of the following:

trade barriers; to impose a barrier/duty/tax/tariff; physical limit; to be subject to tariff as well; foreign competition; it is likely to face; to deprive smb of smth; to penetrate foreign market; safety; to attempt; to favour one foreign producer over another.

V. Give English equivalents of the following:

всупереч; детальніше розглянути дані питання; більш дешеві зарубіжні товари; імпортовані товари широкого вжитку; повна заборона торгівлі; обмеження щодо купівлі товарів; безпосередньо впливати; демпінг; в той час як; навмисне; у відповідності до принципів.

VI. Match the definition on the right with the word on the left. Learn the definitions:

| quota | a) money granted, especially by a government, to an industry needing to help or to keep prices down |

| embargo | b) smth used as a test or measure for qualities |

| boycott | c) a limited quantity of goods allowed to be manufactured, sold or bought |

| dumping | d) a refusal to buy or deal in certain products |

| subsidy | e) when firm or industry sells products on the world market at prices below the cost of production |

| standard | f) a specific type of quota that prohibits all trade |

VII. Fill in the gaps with the words from the list below:

quotas, subsidies, trade barriers, steel tariffs, standards, embargo

1. … given to EU farmers ensure that farmers from outside EU cannot compete.

2. Imposing high product … the government wanted to protect consumers against low quality products.

3. At the end of March, OPEC, which pumps a third of the world’s oil, agreed to reduce production ….

4. … … imposed by the US president destroyed more jobs than they were expected to protect.

5. Even the critics of globalization understand that … … are the danger to free trade.

6. During the 1973 Arab oil … the Pentagon planned to invade and occupy oil fields in eastern Saudi Arabia.

VIII. Match the synonyms. Use any 5 words in the sentences of your own:

| 1) to restrict | a) to destroy |

| 2) to ban | b) to confront |

| 3) to allow | c) to enable |

| 4) to damage | d) to limit |

| 5) to face | e) to prohibit |

IX. Match the words with the opposite meaning. Use any 5 in the sentences of your own:

| 1) to prohibit | a) incomplete |

| 2) to encourage | b) non-tariff |

| 3) complete | c) to discourage |

| 4) likely | d) to allow |

| 5) tariff | e) unlikely |

X. Match the prefixes that give the words the opposite meaning with the groups of adjectives below. Translate the pairs of opposites. Add one or more adjectives to each group:

| dis- il- -im -in ir- un- non- |

| a. | im | possible | probable | precise |

| b. | _______ | honest | similar | organized |

| c. | _______ | popular | economical | manageable |

| d. | _______ | legible | legal | logical |

| e. | _______ | complete | expensive | efficient |

| f. | _______ | regular | relevant | responsible |

| g. | _______ | freezing | existent | stop |

XI. Complete the sentences with the words from ex. X that match the meaning of the underlined phrases:

1. I cannot read your letter. Your handwriting is ______.

2. They work without any breaks. They work ______.

3. This information has nothing to do with your topic. It is ______.

4. You haven’t mentioned all necessary facts. Your report is ______.

5. His car needs too much petrol. It is very ______.

6. She could afford flying to Kyiv. The ticket was ______.

7. Shock therapy had negative effect on the majority of their population. It was a very ______ measure.

XII. Translate into English:

1. Генеральна угода з тарифів і торгівлі сприяла створенню вільної торгівлі між націями.

2. Адміністративні заходи, спрямовані на захист споживача, повинні бути ретельно сплановані.

3. Застосування демпінгової політики руйнує позитивний імідж країни.

4. З якими проблемами ви зіткнулись при підписанні цього контракту?

5. Бойкот та ембарго зазвичай застосовуються з політичних причин.

6. Щоб обмежити зовнішню конкуренцію, уряд вирішив підвищити тарифи на імпорт.

XIII. Topics for discussion:

1) Why do nations erect trade barriers? Give examples of how Ukrainian producers are protected.

2) Speak about non-tariff restrictions on foreign trade. Why should they be eliminated?

3) How are political punitive measures realized through trade relations?

4) Speak about the meaning of the terms “protectionism” and “discrimination”.

5) Explain examples of the application of the respective policies.

XIV. Skills practice:

Assignment 1. Study the commodity price index, published by “The Economist” on March 27, 2004.

| % change on | ||||

| March 16th | March 23rd | one month | one year | |

| Dollar index all items | 98.0 | 100.2 | +3.7 | +32.2 |

| Euro index all items | 104.4 | 107.1 | +6.8 | +14.9 |

| 1995=100 |

Describe the table.

Use the example as a model:

e.g. The Economist’s all-items dollar-based index dropped to 98.0 (based on 1995 as 100) on March 16th and then increased to reach 100.2 on March 23rd. Сommodity price index rose by 3, 7% in the month and by 32.2% in the year to March 27, 2004.

Assignment 2. Using the table say: 1) how the dollar-based commodity prices changed in one week/ one month/ one year; 2) how the euro-based commodity prices changed in one week/ one month/ one year; 3) compare the trends for prices expressed in both currencies.

Unit Fourteen

International Trade Organisations

I. Read and learn the following words and word combinations. Translate the examples:

sign v – підписувати, підписуватись

signatory n – особа, що підписала документ; signatory to a contract/treaty – сторона, що підписала контракт/угоду

signature n – підпис; authorized signature – підпис уповноваженої особи; signature by procuration /proxy – підпис по довіреності

e.g. The General Agreement on Tariffs and Trade was originally signed by 40 countries.

multilateral adj – багатосторонній; multilateral/bilateral agreement – багатостороння/двостороння угода

multilateralism n – багатосторонність; opp. unilateral - односторонній

e.g. Multilateralism is one of the basic principles of the GATT.

the Most-Favoured Nation Principle – принцип найбільшого сприяння сторонам; згідно комерційних угод надаються наступні статуси: national treatment/parity status – національний режим/статус паритету; reciprocal treatment – взаємний режим; the most-favoured nation treatment – режим найбільшого сприяння

unconditional reciprocity – безумовна взаємність

reciprocal adj – взаємний; syn. mutual

e.g. Unconditional reciprocity means the granting of privileges in return for similar privileges.

negotiate v – 1) вести переговори, домовлятися, обговорювати (умови); 2) отримувати (договір, контракт); 3) продавати, реалізовувати

negotiations n – переговори, обговорення умов; syn. talks; negotiator – 1) учасник переговорів; 2) посередник; round of negotiations – раунд переговорів/цикл переговорів

e.g. The WTO rules – the agreements – are the result of negotiations between the members.

commitment n – зобов’язання; syn. promise, duty, agreement; в тексті: режим, регламент; syn. schedule

e.g. Individual members of the WTO make separate commitments called schedules.

review v – 1) розглядати, переглядати; 2) перевіряти, проглядати

review n – 1) перегляд; 2) огляд; 3) рецензія, відгук; to be subject to review – підлягати перегляду; Trade Policy Review Body – орган по перегляду торгівельної політики

e.g. The General Council also meets as the Trade Policy Review Body.

settle v – 1) вирішувати; 2) домовлятись, дійти згоди; 3) розрахуватись; 4) владнати, врегулювати

settlement n – 1) розрахунок, погашення (боргу); 2) врегулювання; clearing settlement – безготівковий розрахунок; settlement in cash – готівковий розрахунок; settlement in foreign/national currency – розрахунок в іноземній/національній валюті; full/partial settlement – повний/частковий розрахунок; settlement of dispute/problem – врегулювання конфлікту/проблеми; Dispute Settlement Body – орган з врегулювання конфліктів

e.g. The General Council also meets as the Dispute Settlement Body.

arrange v – 1) систематизувати, впорядковувати; 2) досягти угоди

arranged adj – впорядкований

arrangement n – 1) розміщення в певному порядку, організація, систематизація; 2) домовленість, угода; 3) pl. заходи; syn. measures

e.g. There are many arrangements to promote free trade.

II. Read and translate the text:

International Trade Organisations

The GATT system

The General Agreement on Tariffs and Trade (GATT) was established in 1948. It provided the basis for trade negotiations since the end of the World War II. The original agreement was signed by more than 40 countries. Later the number of signatories increased to about 100, which together accounted for more than 80 per cent of the world trade. The GATT had a secretariat and headquarters in Geneva.

The fundamental purpose of the GATT was to achieve free and fair trade through reduction of tariffs and elimination of other trade barriers. GATT operated on the basis of three principles: 1) non-discrimination, multilateralism and the application of the Most-Favoured Nation Principle to all signatories; 2) expansion of trade through the reduction of trade barriers; 3) unconditional reciprocity among all signatories. GATT's goal was to establish a world trade regime or universal rules for the conduct of commercial policy.

GATT was not only a set of rules, it was also a forum in which countries could discuss their trade problems. GATT’s most important activity was in the rounds of talks held since 1948. Trade negotiations within the framework of the GATT led to considerable decline of tariff barriers and growth in world trade. The Kennedy Round (May 1964 – June 1967) was of major importance in the movement toward trade liberalization. It employed a new method of tariff negotiations which resulted in tariff reduction of 35 per cent on 60.000 products.

By the late 1970s several changes started to erode the GATT system of trade liberalization. As tariff barriers within the GATT fell, non-tariff barriers appeared. Barter or counter-trade, especially in respect of the less developed countries, increased from 2-3 to 25-30% of the world trade. Government intervention in trade relations to protect home economy became a norm.

In the 1980s it became evident that the era of successive rounds of multilateral trade negotiations ended. Transformations of the global pattern of international trade stimulated the development of a new international trading regime.

World Trade Organization (WTO)

The successor to the GATT is the World Trade Organization (WTO). It has more than 130 members which account for over 90 per cent of the world trade. Over 30 others are negotiating membership.

The WTO’s objective is to help trade flow smoothly, freely, fairly and predictably. This is achieved by: 1) administering trade agreements; 2) acting as a forum for trade negotiations 3) settling trade disputes; 4) reviewing national trade policies; 5) assisting developing countries in trade policy issues through technical assistance and training programmes; 6) cooperating with other international organizations.

Decisions are made by the entire membership. This is typically by consensus. The WTO agreements have been ratified in all members’ parliaments. The WTO top-level decision making body is the Ministerial Conference which meets at least once every two years. Below this is the General Council which meets several times a year in the Geneva Headquarters. The General Council also meets as the Trade Policy Review Body and the Dispute Settlement Body. At the next level the Goods Council, Services Council and Intellectual Property Council report to the General Council.

The WTO rules – the agreements – are the result of negotiations between the members. The current agreements are the result of the 1986-94 Uruguay Round negotiations which included a major revision of the original General Agreement on Tariffs and Trade (GATT).

GATT is now the WTO’s principal rule-book for trade in goods. The Uruguay Round also created new rules for dealing with trade in services, relevant aspects of intellectual property, dispute settlement, and trade policy reviews The complete set consists of about 60 agreements and separate commitments (called schedules), made by individual members in specific areas such as lower customs duty rates and services market-opening.

Through these agreements, WTO members operate a non-discriminatory trading system that establishes their rights and their obligations. Each country receives guarantees that its exports will be treated fairly in other countries’ markets. Each promises to do the same for imports into its own market. The system also gives developing countries some flexibility in implementing their commitments.

Some countries feel that their economies will be strengthened if they establish trade agreements with other countries in the same region. Some of these agreements involve forming producers’ cartels and common markets.

Producers’ cartels are organizations of commodity-producing countries. They are formed to stabilize or increase prices, optimizing overall profits in the long run. The most obvious example today is OPEC (Organization of Petroleum Exporting Countries).

A Common Market is a regional group of countries that have no internal tariffs. Common markets have a common external tariff and a coordination of laws to facilitate exchange. Vivid examples are the European Economic Community (EEC), the Central American Common Market (CACM) and the Caribbean Common Market (CCM).

There are many more such arrangements including negotiating groups that join together to negotiate trade agreements, commodity associations that bring together countries concerned with specific commodities, commodity agreements which are multilateral agreements among buyers and sellers to stabilize prices and more.

III. Answer the following questions:

1. With what purpose was the GATT established?

2. What are the basic principles of the GATT?

|

|